From 1 July 2024, businesses will face new procedures for the transmission of invoices (“e-invoicing”) and transaction data (“e-reporting”).

The application of one and/or the other procedure will depend on the place of establishment of the parties, the territoriality rules allowing to determine whether the transaction falls within the scope of application of French VAT, as well as the applicable invoicing rules.

Read more

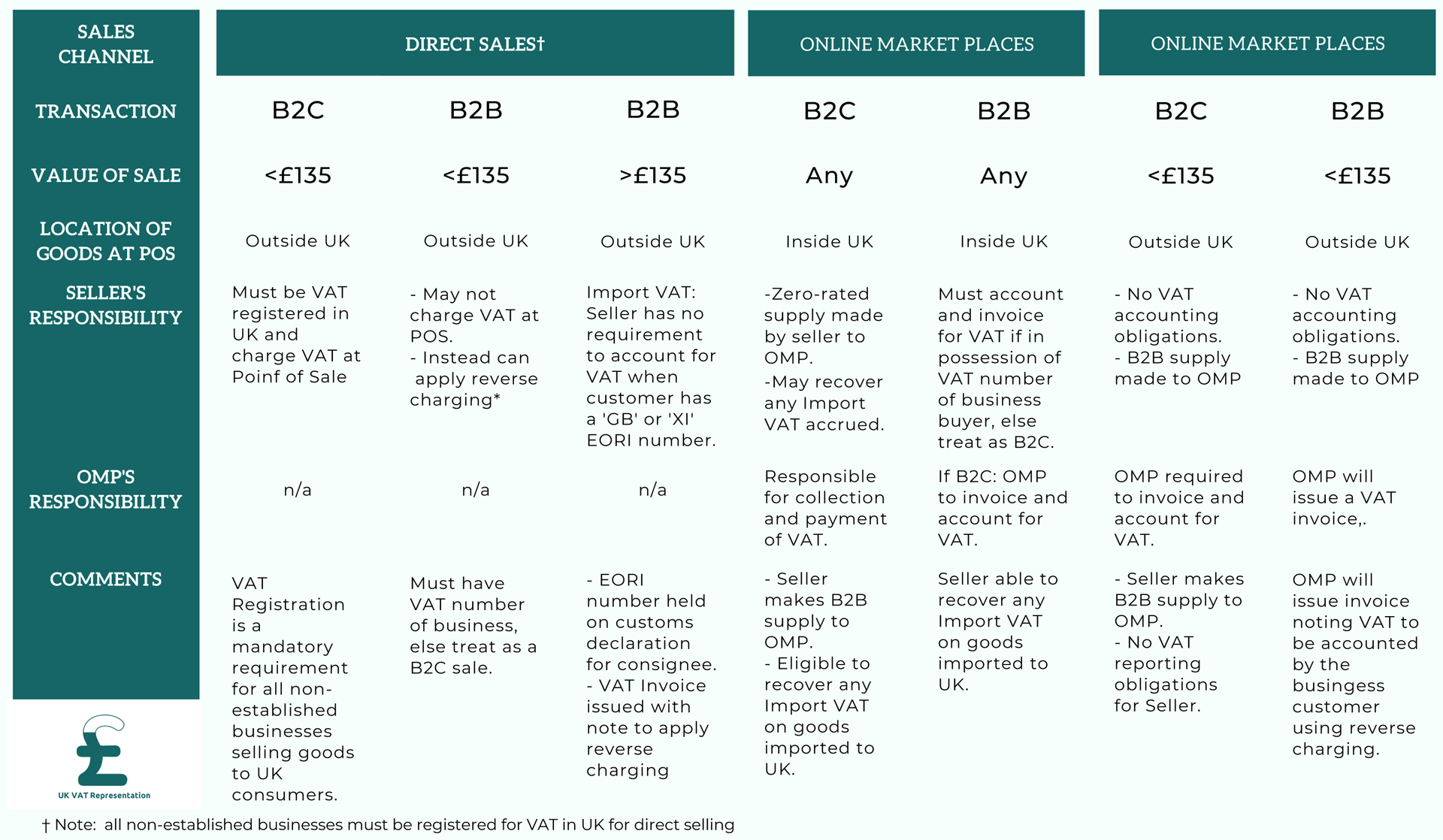

UK Distance Selling Rules in Summary

Changes to distance selling rules for the UK were implemented as part of The Taxation (Post-transition Period) Act. This document provides a summary of the changes as at 1st January 2021. Read more

Webinar | E-Commerce: new EU VAT rules for B2C distance sales of goods and services will come into force on July 1, 2021

A major VAT reform is coming in effect on July 1, 2021 in the Member States of the European Union. Companies providing certain services or deliveries of goods to private individuals located in the EU Member States, will be able to register at the VAT Mini One Stop Shop (MOSS) in a single EU Member State, where they can declare and pay VAT on all of their sales in EU Member States. Read more

E-invoices in Poland

The Ministry of Finance announces the introduction of e-invoices.

The Ministry of Finance has published a draft amendment to the VAT Act, which announces the introduction of e-invoices, i.e. a standardized form of a document which will be transparent and legible for all users. The new solution will not be obligatory from the beginning however the taxpayer choosing e-invoices will receive a VAT refund faster. Read more

Principle of continuity for unfinished operations between the eu and the uk at the end of 2020

Continuity principle for unfinished operations between eu and uk (at the end of 2020)

The transitional period, which began on February 1, 2020, which extended the tax effects of Brexit to January 1, 2021, ended on December 31, 2020.

According to the provisions of the Agreement on the withdrawal of the United Kingdom of Great Britain and Northern Ireland from the European Union, the United Kingdom will no longer be part of the Unique Market and the Customs Union of the EU and will become, in effect, for the purposes of VAT, a “third country”. Read more

La Représentation Fiscal is a founding member of the Association of French Tax Representatives

La Représentation Fiscal (LRF) is a founding member of the Association of French Tax Representatives (Association des Représentants Fiscaux Français – ARFF), a professional association with a mission to offer its Members a forum for discussion and exchange on any tax or customs subject related to the tasks of accredited tax representative. Read more

France: new way of calculating VAT for short term yacht charters

The French Tax Authorities have published a new tax bulletin on 6 November 2020, with retroactive effect from 1 November, which affects the way VAT on short term charters is calculated depending on time spent within/outside EU waters. Read more

France: Simplification of formalities related to distance sales (B2C) of excise products from January 1, 2020

Finance Law No. 2019-1479 of December 28, 2019 for 2020 has simplified the formalities relating to distance sales of products subject to excise duty.

This provision covers the sales of excise products already released for consumption in a Member State of the European Union and sent directly or indirectly by a supplier not established in France to be delivered to individuals residing in France (B2C). Read more

How non UK suppliers will account for VAT on sales to English end consumers (B2C) post 31 December 2020: Brexit effects

The UK will opt for a mechanism similar to the One Stop Shop (OSS) coming in on mainland Europe from 1 July 2021, but in the case of the UK this will be introduced when transition period for the UK to exit the European Union ends. Read more

New “Taxes in Europe database”

The EU Commission has just published the new “Taxes in Europe database”, collecting all information on standard, reduced and zero VAT rates on all goods and services in EU Member States.

Read more

- « Previous Page

- 1

- 2

- 3

- 4

- …

- 11

- Next Page »