On January 18th of 2018, the European Commission has proposed new simplification rules to help reduce VAT compliance cost for small businesses.

The aims to broadly overhaul current rules, establishing a robust single European VAT area fit for an increasingly globalised world. The proposed reforms will contribute to the creation of a modern, more efficient and fraud-proof VAT system, while enhancing Member States’ ability to collect revenues.

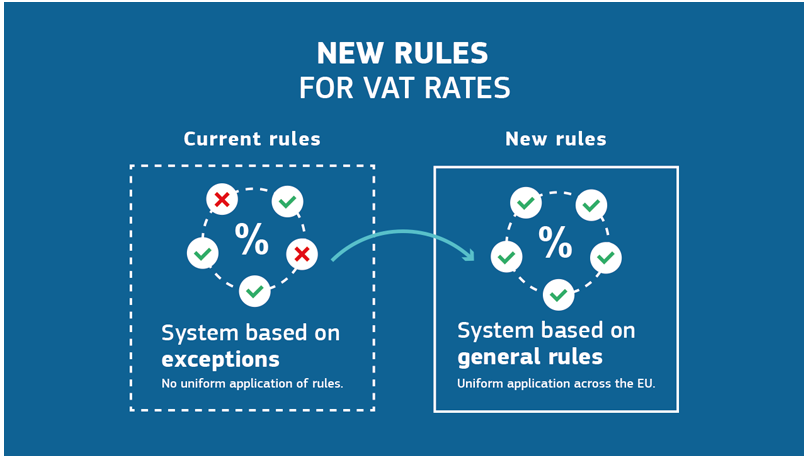

The aims of the proposals are twofold: to meet demands from Member States to have more flexibility to set rates and to extend VAT exemptions that exist for domestic companies to small companies trading cross-border.

The legislative proposal will now be submitted to the European Parliament and the European Economic and Social Committee for consultation and to the Council for adoption.

The Proposal:

“More flexibility

Member States can currently apply a reduced rate of as low as 5% to two distinct categories of products in their country. A number of Member States also apply specific derogations for further reduced rates.

In addition to a standard VAT rate of minimum 15%, Member States would now be able to put in place:

- Two separate reduced rates of between 5% and the standard rate chosen by the Member State;

- One exemption from VAT (or ‘zero rate’);

- One reduced rate set at between 0% and the reduced rates.

The current, complex list of goods and services to which reduced rates can be applied would be abolished and replaced by a new list of products (such as weapons, alcoholic beverages, gambling and tobacco) to which the standard rate of 15% or above would always be applied.

To safeguard public revenues, Member States will also have to ensure that the weighted average VAT rate is at least 12%.

The new regime also means that all goods currently enjoying rates different from the standard rate can continue to do so. “

For more details – view the infographic on the VAT Rates proposal on the website: https://ec.europa.eu/taxation_customs/sites/taxation/files/18012017_factsheet_vat_rates.pdf

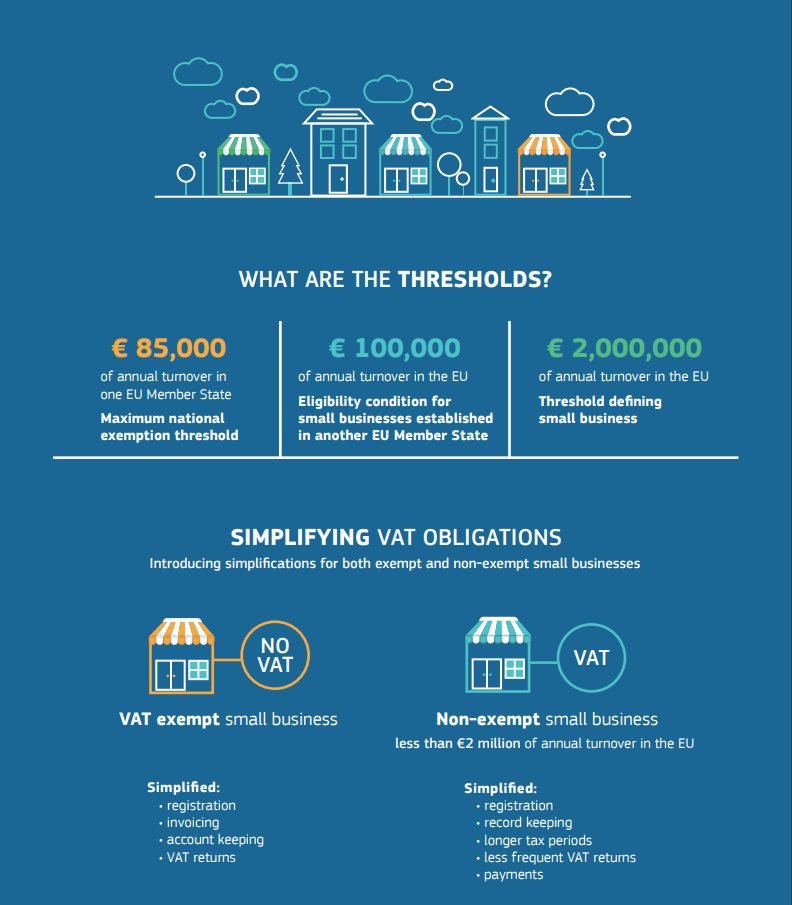

“Reducing VAT costs for SMEs

Under current rules, Member States can exempt sales of small companies from VAT provided they do not exceed a given annual turnover, which varies from one country to the next. Growing SMEs lose their access to simplification measures once the exemption threshold has been exceeded. Also, these exemptions are available only to domestic players. This means that there is no level playing field for small companies trading within the EU.

While the current exemption thresholds would remain, today’s proposals would introduce:

- A €2 million revenue threshold across the EU, under which small businesses would benefit from simplification measures, whether or not they have already been exempted from VAT;

- The possibility for Member States to free all small businesses that qualify for a VAT exemption from obligations relating to identification, invoicing, accounting or returns;

- A turnover threshold of €100,000 which would allow companies operating in more than one Member State to benefit from the VAT exemption.

These legislative proposals will now be submitted to the European Parliament and the European Economic and Social Committee for consultation and to the Council for adoption. The amendments will become effective only when the switch to the definitive regime effectively takes place.”

For more details – read the infographic on VAT for small businesses on the website: https://ec.europa.eu/taxation_customs/sites/taxation/files/18012018_factsheet_vat_smes.pdf