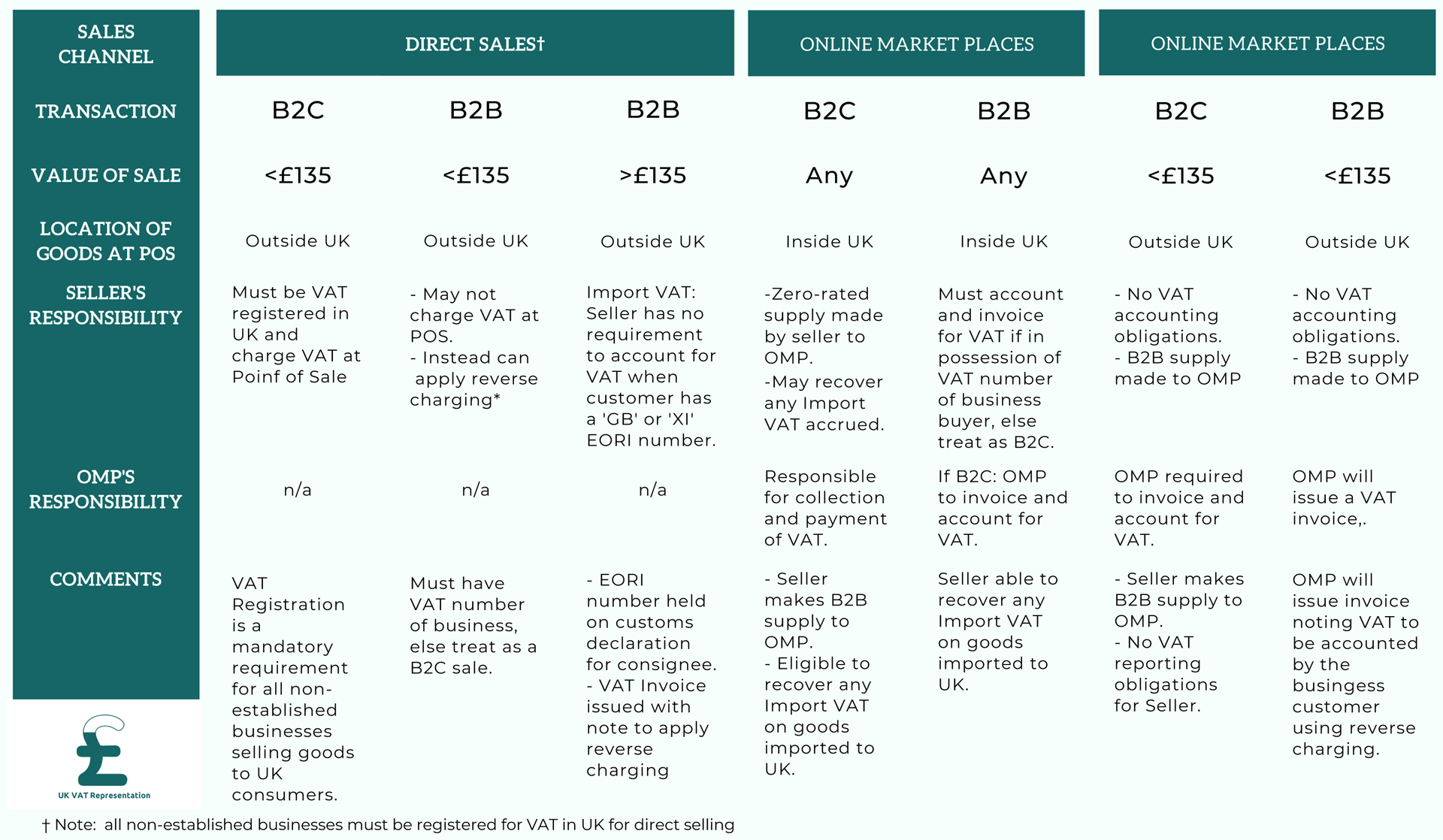

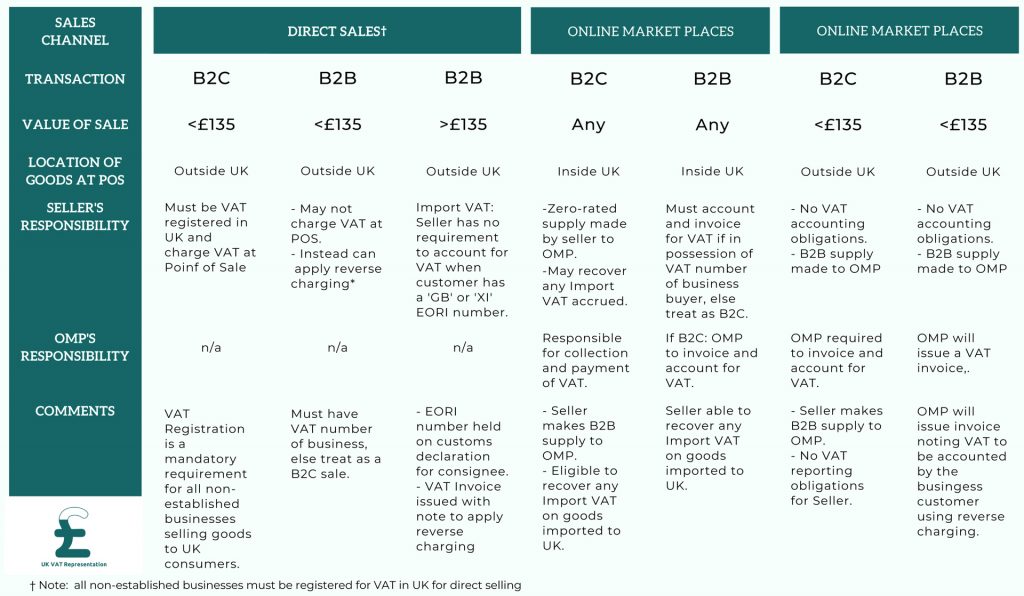

Changes to distance selling rules for the UK were implemented as part of The Taxation (Post-transition Period) Act. This document provides a summary of the changes as at 1st January 2021.

Distance Selling: Other Key Changes

Low Value Consignment Relief (LCVR)

Low Value Consignment Relief which allowed goods under the value of £15 to be imported into the UK has been abolished. All goods imported under the value of £135 must now have VAT applied at the appropriate rate ie standard rate (20%), reduced rate (5%) or zero-rated (0%), unless exempted by HMRC.

Application of VAT Rules for Non-established Businesses

All non-established businesses directly selling goods into the UK, apart from those selling exempted products must be registered for VAT, irrespective of their turnover. In addition these businesses should also apply for a “GB” EORI number.

Definition of Online Market Places (OMPs)

Online market places are categorised as businesses which facilitate the supply of goods if all of the following conditions are met:

- process or facilitate the processing of payments for the purchase of goods;

- establish terms and conditions for the online sales of goods;

- arrange the ordering and delivery, or facilitate the ordering and delivery, of the goods.

However, any business which only provides one of the following services will not be regarded as an OMP:

- the listing and advertising of goods for sale;

- processing of payments relating to the supply of goods;

- the redirection or transfer of customers to another site or location, where the goods are offered for sale, with no further intervention in their supply.

Methods for Calculating the Valuation of Goods

The value of the goods will be calculated on the basis on their advertised price. Therefore, if the advertised price of the goods sold does not include the costs of shipping and insurance; and these are shown as a separate line on the invoice, then the valuation will be based on the goods alone.

Where two or more items are sold, but are combined into a single consignment which exceeds £135, this will attract import VAT and customs duties, as appropriate. However, multiple goods purchased in a single transaction, but shipped in two or more consignments, each less than £135, may be allowed to be shipped free of customs duty under these rules.